Web3 mass adoption is here: Mundane Milestones

While the rise of web3 has often been marked by hype and excitement, it’s the mundane use-cases that really move us toward the mass adoption of blockchain tech.

Blockchain – The Next Evolution

As we have often said, the road to mass adoption is a bumpy one. For the past several years, it’s been amazingly easy for many “normies” to write this new technology off as an overhyped trend, or (even worse) as some sort of gimmick. But as any of us who have been pioneering in this space since its earliest days can assure you, it’s anything but a gimmick.

Blockchain represents a fundamental shift in the way information is shared and managed in the digital era. In just a few short decades, computer technology has advanced in ways that previous generations couldn’t have imagined. The widespread adoption of new tools such as home computers and (more recently) smartphones has led to unprecedented levels of connectivity and a world of new possibilities.

Blockchain tech has the power and potential to decentralize numerous world industries, giving users power, freedom and control like they have never known. In the past, all consumers have been required to put their trust in companies whose coffers made it possible for them to take advantage of the latest technology. But as state-of-the-art tech has consistently been shared with consumers faster and faster, it is now possible for decentralized networks to take shape and start running things that were previously managed by centralized corporations.

Even while crypto and blockchain advocates have been talking for years about the seemingly endless quest for “mass adoption,” the growth of blockchain technology has ultimately been running its course like any technology. In reality, mass adoption of blockchain doesn’t rely on hype, trends or the enthusiastic endorsement of multimedia influencers and crypto personalities. In fact, it’s very possible that these evangelistic approaches have slowed the march toward mass adoption rather than expedited it. When fanatics are shouting loudly with glitz and glamor, it’s easy for more discerning and pragmatic individuals to become skeptical.

Moore’s Law

In 1965, a man named Gordon E. Moore (co-founder of Intel) famously predicted that the number of transistors in computer chips would double approximately every 2 years.

While Moore initially expected this pattern to hold true for at least 10 years, it has consistently proven itself for more than five decades

LEARN MOORE:

“What is Moore’s Law?” – Our World in Data, March 2023

Interestingly, the worldwide recorded data creation and consumption figures follow the same pattern almost perfectly.

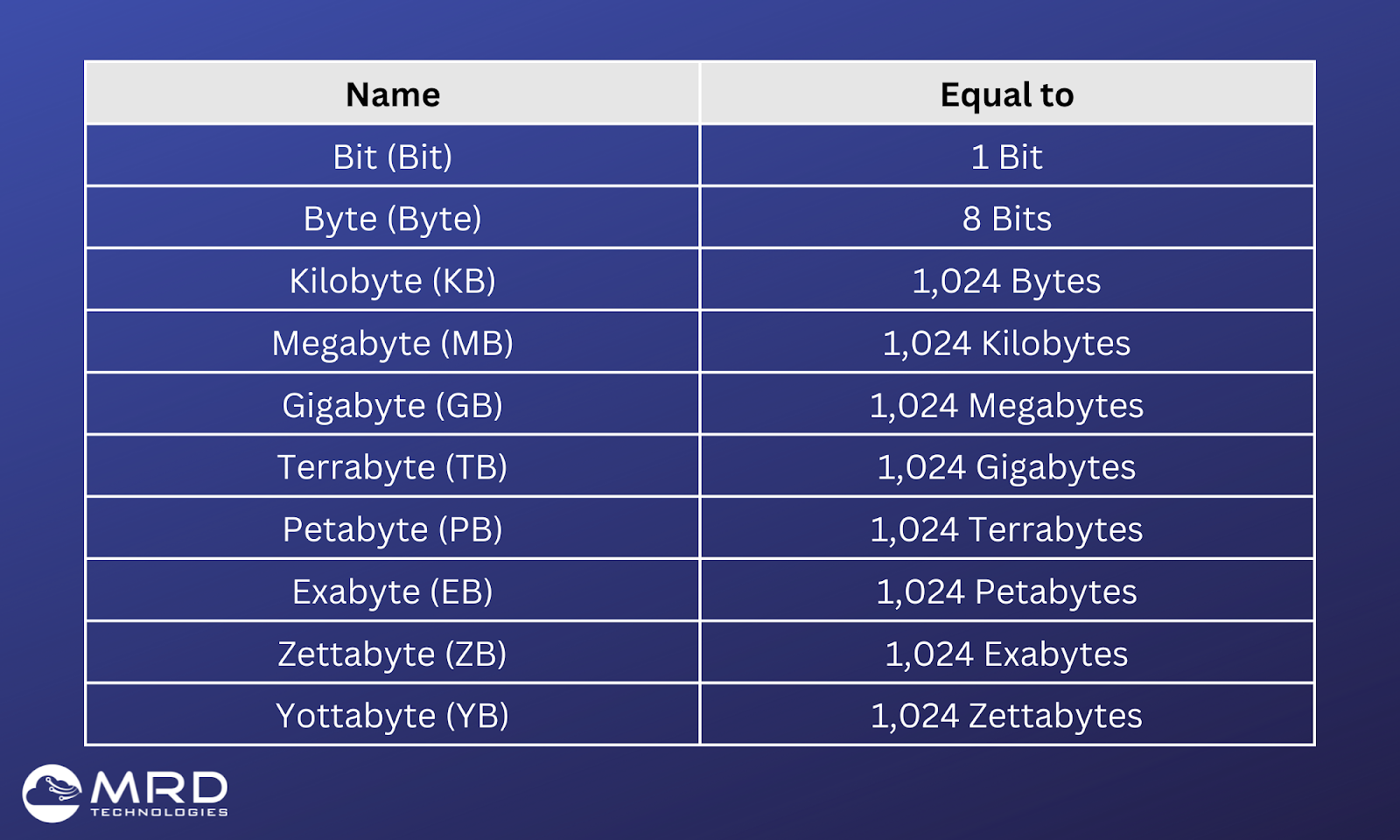

In 2010, the total amount of data created, captured, copied and consumed globally was 2 zettabytes…

SOURCE – “What is a Zettabyte?” – MRD Technologies, November 2022

In 2020, the total amount of data created, captured, copied and consumed globally was 64.2 zettabytes. This amounts to almost exactly 5 doublings, adhering quite precisely to Moore’s Law:

2010➡️2012 – 2 zettabytes➡️4 zettabytes

2012➡️2014 – 4 zettabytes➡️8 zettabytes

2014➡️2016 – 8 zettabytes➡️16 zettabytes

2016➡️2018 – 16 zettabytes➡️32 zettabytes

2018➡️2020 – 32 zettabytes➡️64 zettabytes… 🤯

Blockchain is what Blockchain does

The decentralized power of blockchain systems is not in the identity of blockchain, but the benefits created by them. While in the early days of web3 it was possible to gather a certain degree of attention by labeling a project as “blockchain,” now it’s all about what your project can do, rather than how it was built.

In the same way that we are typically unable to see the internal operations of our computers and phones with our own eyes, there has never been a real need (beyond the trend) to peer under the surface of blockchain technology, at least for 99% of its users.

While the transparent Swatch with inner workings exposed had its glory day in the late eighties, most watch-wearers would prefer today to hide those operations behind a shiny casing. In the web3 world, a user is far more likely to care about the ease with which they can transact on a platform than the smart contracts behind the scenes that make their (often complex) transaction possible.

There are of course many blockchain fanatics today who are absolutely fascinated with the internal details (The GalaChain team is among them). Still, mass adoption for this budding technology means it will be used to improve various industries throughout the world, without always taking a starring role.

For the rest of this blog, let’s explore some of the “mundane milestones” that prove blockchain is just getting started. These are the unsung heroes in the fight for mass adoption against the corporate giants who have run the show for so long in the web2 era.

Mundane Milestones

Supply Chain Transparency in Retail

Transparency in retail supply chains is an unsung hero of the blockchain revolution.

In recent years, several major retailers have already adopted blockchain technology to enhance supply chain transparency, allowing consumers to trace the journey of products from origin to store shelf. For instance, Carrefour has implemented blockchain to provide detailed information about the nature and origin of their products, enabling shoppers to access data such as harvest dates, cultivation locations, and safety certifications by scanning a QR code on the food label or packaging.

After a multitude of supply chain issues following the pandemic of 2020 and 2021, IBM is offering corporate blockchain solutions to enhance transparency and tracking for supply chains, acknowledging that 73% of consumers have reported that traceability of products is important to them.

Similarly, Desigual has deployed blockchain solutions to improve visibility in their supply chain, marking an important step towards greater transparency and accountability in meeting customer needs.

These initiatives reflect a broader trend among retailers to leverage blockchain for building trust and ensuring product authenticity.

Insurance Claims Processing

Insurance claims can be automated on an unprecedented scale thanks to blockchain.

The insurance industry has always relied on reports and records, especially when it comes to things like processing claims and underwriting new policies. Blockchain tech is increasingly being adopted in claims processing to enhance efficiency, transparency and security.

For example, Lemonade, Inc. has implemented blockchain-based parametric insurance for Kenyan farmers, using smart contracts to automatically process claims based on predefined events like droughts with no need for intervention by human agents. This system has already been proven effective in 2023 as ~7000 farmers successfully received payouts due to drought conditions.

Another example of insurance utilizing blockchain is Etherisc, the decentralized insurance platform. By using blockchain and smart contracts to streamline various insurance processes, Etherisc is able to automate many of the processes involved with insurance claims, reducing overhead and minimizing the threat of fraud.

LEARN MORE:

“Is blockchain the next big thing for insurance companies?” – Reuters, October 2024

“Top Use Cases for Blockchain in Insurance” – Insurance Thought Leadership, April 2024

Real Estate Tokenization for Shared Ownership

Tokenization brings new possibilities of fractional ownership to real estate markets.

Tokenization of real estate ownership is on the rise, representing one of the simplest ways for blockchain technology to streamline an already thriving industry. Tokenized real estate can make fractional ownership easier than ever, allowing investors to buy portions of property without the need for substantial capital.

In an early example of real estate tokenization from way back in 2018, a Colorado resort called St. Regis Aspen made history with a first-of-its kind REIT (real estate investment trust) IPO, selling $18M worth of shares in its property as blockchain tokens.

This elegant use case for tokenization has led to the creation of several blockchain-based real estate platforms that enable fractional ownership and the benefits of tokenized trading, such as HoneyBricks and Lofty.

LEARN MORE:

“The Ultimate Guide to Investing in Tokenized Real Estate” – HoneyBricks

Decentralized Identity for Public Services

Decentralized Identity (DID) is an emerging blockchain-adjacent technology field that allows individuals to manage digital identities without having to rely on centralized authorities. By using blockchain and other decentralized technologies, DID can enhance privacy and security, giving users the ability to control their own personal information and share it selectively with various service providers. Here are some of the ways that DID can transform the efficiency of various public services:

- Citizen Services – Governments can use DID to issue decentralized identities to citizens, facilitating easy access to services such as passport renewals, tax filing and voter registration. These uses could drastically reduce bureaucratic hurdles in traditionally inefficient areas.

- Enhanced Privacy – DID systems have the potential to greatly reduce threats and breaches of privacy with personal data.

- Interoperability – DID frameworks are designed to fit into larger systems, promoting a new standard of interoperability to different kinds of platforms and services.

One major example of DID in action is China RealDID, China’s national decentralized identity system that was launched in late 2023. This program allows Chinese residents to access online services with DID addresses and private keys.

LEARN MORE:

“Decentralized Identity Management in Distributed Systems” – Geeks for Geeks, October 2024

Digital Health Records in Clinical Trials

Blockchain tech is also being adopted in the medical field, especially with clinical trials, to enhance the management of health records. There are a few key benefits:

- Data integrity – Blockchain can ensure that health records are tamper-proof, maintaining authentic and reliable data through the duration of a clinical trial. This consistency and reliability are crucial for not just the validity of the findings, but for regulatory compliance issues.

- Transparency – The transparent nature of blockchain allows researchers, participants and regulators to access and verify data in real-time, helping to foster greater trust and collaboration.

- Efficiency in sharing data – Blockchain makes it possible to seamlessly and securely share health records among authorized parties, reducing the delays and administrative burdens that often come with more traditional methods of data exchange.

Huge strides have already been made for blockchain in the field of medical research and record-keeping, especially surrounding clinical trials for new treatments and medicines.

Intellectual Property Rights Management

While this issue will be a long-term challenge and a tough nut to crack, blockchain databases stand to solve the multitudinous problems of managing intellectual property in the internet era. Digital piracy has been an ongoing concern in every growth stage of the internet, from pirated music and torrents to stolen art minted as NFTs and sold for huge sums.

Now, with the often chaotic addition of AI generated material in all forms, it is as difficult as ever to attribute proper credit to the owner of any digital asset. Blockchain protocols and projects are already working on solving these problems by addressing the following:

- Proof of creation and ownership – Blockchain allows owners to timestamp their work to establish verifiable evidence of its creation and their ownership. Particularly valuable in copyright disputes, this evidence would provide an immutable record of when a work was created. For example, Bernstein.io, SaharaLabs.ai and others are creating a framework to track and protect creative intellectual property using blockchain.

- Automated licensing and royalty distribution – One of the biggest challenges of managing IP is ensuring that the creator is paid, a problem that is solvable by blockchain using well-placed smart contracts.

- Supply chain transparency and anti-counterfeiting – Blockchain can track the provenance of goods to ensure authenticity. By recording each step of a product’s journey, consumers and companies can verify the legitimacy of their goods. The European Union Intellectual Property Office (EUIPO) founded an Anti-Counterfeiting Forum in an effort to establish blockchain ecosystems to protect trademarks and designs.

LEARN MORE:

“IP is a journey: blockchain and encrypted storage are your best friends” – WIPO Magazine, 2021

It’s Not Always in the Headlines

In the journey toward mass adoption of web3 technologies, it’s often the understated advancements that drive significant progress.

While high-profile developments, volatile token price swings and NFT rug pulls easily capture headlines, it’s the integration of blockchain into everyday processes (like those described above) that truly propels innovation. These “mundane milestones” may not always garner widespread attention, but they lay the essential groundwork for a more decentralized and efficient future, moving the needle of innovation in meaningful ways.

GalaChain is Ready

Whatever the industry and whatever the problem, there’s a good chance that GalaChain is in a great position to help solve it. This layer-1 blockchain has the speed, scalability and security needed to tackle serious issues in numerous world industries, no matter how insignificant they seem. So here’s the next big innovations in the adoption of blockchain technology for a better future… Here’s to the unsung heroes… Here’s to the Mundane Milestones.